Ever felt house-rich but cash-poor? You’re not alone. Millions of homeowners are sitting on a goldmine of equity while their checking accounts tell a different story.

What if you could tap into that equity without selling your home? That’s where a home equity line of credit comes in – your financial secret weapon hiding in plain sight.

Think of it as a flexible credit card secured by your home’s value. You borrow what you need, when you need it, only paying interest on what you use.

But here’s what most lenders won’t tell you upfront: the way you structure your HELOC can either save you thousands or cost you dearly in the long run. The difference often comes down to knowing just three key factors…

How a HELOC works

Understanding the Basics

A Home Equity Line of Credit (HELOC) isn’t nearly as complicated as that mouthful of a name suggests. Think of it as a credit card that uses your house as collateral.

Unlike a regular home equity loan where you get a lump sum upfront, a HELOC gives you access to a pool of money that you can dip into whenever you need it, up to a predetermined limit. You only pay interest on what you actually borrow, not the entire available amount.

The money sitting there untouched? That doesn’t cost you a penny in interest. Pretty sweet deal when you think about it.

Phases of a HELOC

HELOCs typically operate in two distinct phases, and knowing the difference is crucial before you sign on the dotted line.

Draw Period

The first phase is called the draw period, which usually lasts 5-10 years. During this time, you can:

- Withdraw money as needed (up to your credit limit)

- Make interest-only payments on the amount borrowed

- Potentially pay off and reborrow funds multiple times

It’s like having a financial safety net that’s there when you need it. Roof starts leaking? HELOC. Kid heading to college? HELOC. Kitchen desperately needs an update? You guessed it.

Many homeowners love the flexibility during this period. You’re only required to make minimum payments (often just the interest), though paying more is always an option if you want to chip away at that principal.

Repayment Period

After the draw period ends, you enter the repayment period, which typically lasts 10-20 years. Things change significantly:

- You can no longer withdraw funds

- Payments include both principal and interest

- Monthly payments can increase substantially

This is where some borrowers get into trouble. Those comfortable interest-only payments suddenly jump when principal gets added to the mix. If you’ve maxed out your HELOC, prepare for some payment shock.

How Lenders Determine Your HELOC Amount

Curious how banks decide how much to offer? It’s not random, and it’s not just about how much you think you need.

Equity Calculation

The first thing lenders look at is your home equity. Most will let you borrow up to 80-85% of your home’s value, minus what you still owe on your mortgage.

Let’s break this down with real numbers:

Home value: $400,000

Mortgage balance: $250,000

Equity: $150,000

If the lender uses an 80% loan-to-value ratio:

$400,000 × 80% = $320,000 (total allowable debt)

$320,000 - $250,000 (existing mortgage) = $70,000 potential HELOC

That means you could potentially access $70,000 through your HELOC.

Credit Score Impact

Your credit score plays a huge role too. A score above 740 will usually get you the best rates and highest limits. Below 620? You might struggle to get approved at all.

The difference between “excellent” and “fair” credit could mean tens of thousands in available credit and percentage points on your interest rate.

Debt-to-Income Ratio

Banks want to make sure you can handle the payments if you max out your line. They’ll look at your debt-to-income ratio (DTI), which compares your monthly debt payments to your monthly income.

Most lenders want to see a DTI under 43%, though some might go higher for strong applicants.

Interest Rates and How They Work

HELOC interest rates deserve special attention because they’re different from what you might be used to with your mortgage.

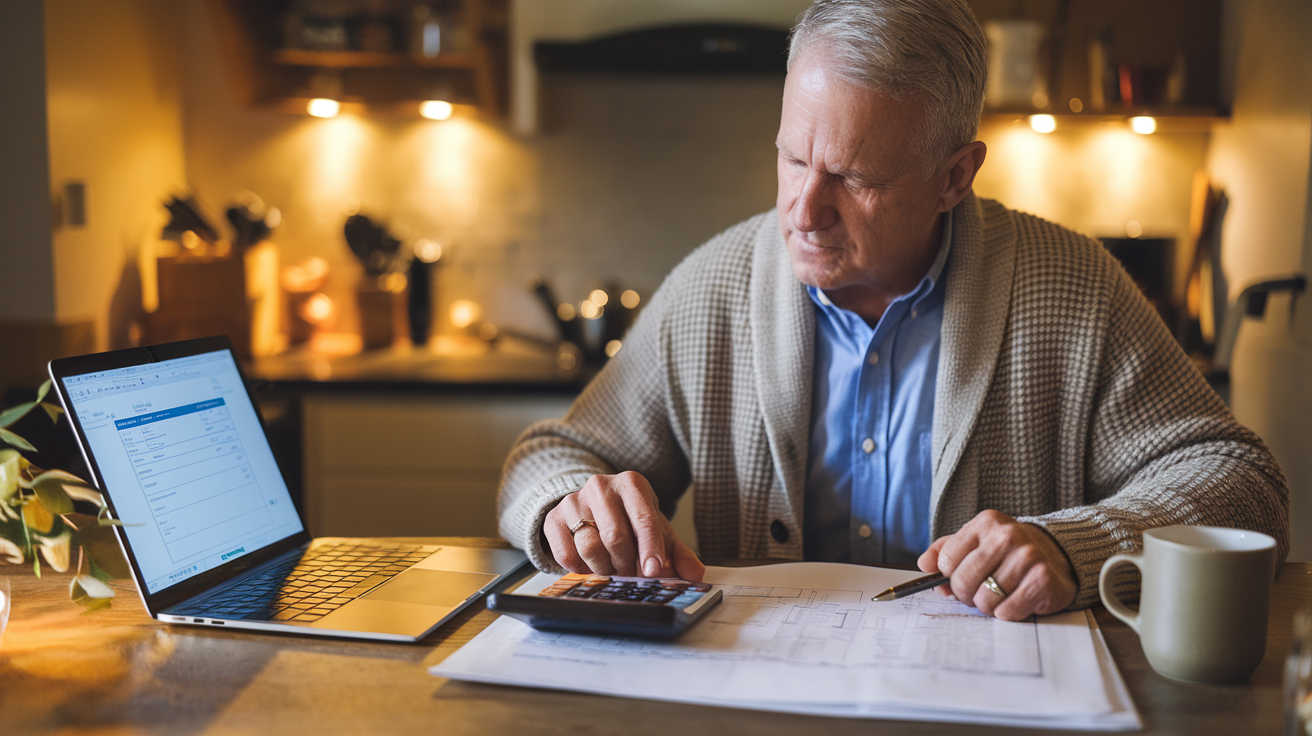

Variable vs. Fixed Rates

The vast majority of HELOCs come with variable interest rates. This means your rate can (and will) change over time based on broader economic factors, specifically the prime rate.

When the news talks about the Federal Reserve raising rates? That affects your HELOC almost immediately.

Some lenders offer fixed-rate options or even hybrid products. These might allow you to lock in rates on portions of your balance or convert from variable to fixed under certain conditions.

Rate Caps and Floors

Pay close attention to rate caps in your HELOC agreement. These limit how much your rate can increase:

- Periodic caps: Limit how much rates can increase in a single adjustment

- Lifetime caps: Set the maximum rate you’ll ever pay

Without these protections, a HELOC could become unaffordable if rates spike dramatically.

Margin Explained

Your HELOC rate is typically calculated as the prime rate plus a margin. That margin is based on your creditworthiness and is set when you open the account.

For example, if the prime rate is 5.5% and your margin is 1%, your HELOC rate would be 6.5%.

The margin stays the same throughout your HELOC term, but since the prime rate fluctuates, your overall rate will too.

Fees and Costs to Watch For

HELOCs aren’t free money—there are costs involved that can add up quickly if you’re not careful.

Application and Origination Fees

Just like with a mortgage, many lenders charge upfront fees to process your application and set up your HELOC. These can range from $0 to $500+, depending on the lender.

Some lenders waive these fees as promotions, especially for customers with excellent credit or those with existing accounts.

Annual Maintenance Fees

Many HELOCs come with yearly fees just to keep the account open, typically ranging from $25 to $75. This might not seem like much, but it adds up over a 10-year draw period.

The catch? You pay this even if you don’t use your HELOC at all that year.

Early Termination Fees

Close your HELOC too soon (usually within 3-5 years of opening), and you might get hit with an early termination fee, sometimes called a cancellation fee.

These can run several hundred dollars or even require repayment of closing costs that were initially waived.

Inactivity Fees

Some lenders charge if you don’t use your HELOC. Yes, you read that right—you can get charged for NOT borrowing money.

Typically $50-$100 per year, these fees encourage you to maintain at least some balance (and pay interest).

Accessing Your HELOC Funds

Once your HELOC is approved, you need to know how to actually get at that money when you need it.

HELOC Checks

Most lenders provide special checks linked to your HELOC account. Write a check, and the amount is added to your HELOC balance.

These work just like regular checks but draw against your home equity instead of a checking account.

Online Transfers

Almost all modern HELOCs allow online transfers between your HELOC and other bank accounts. This is typically the fastest way to access your funds.

Many banks offer same-day transfers if initiated before a certain cutoff time.

HELOC Cards

Some lenders provide card access—similar to a credit card but linked to your HELOC account. This makes small purchases convenient without writing checks.

Just be careful—that card makes it awfully easy to tap your home equity for everyday spending, which financial advisors generally recommend against.

Tax Implications of HELOCs

The tax situation around HELOCs changed significantly with the Tax Cuts and Jobs Act of 2017, and it’s important to understand the current rules.

Interest Deductibility

HELOC interest is only tax-deductible if the funds are used for buying, building, or substantially improving the home that secures the loan.

Use your HELOC for college tuition or consolidating credit card debt? Sorry, that interest isn’t deductible anymore.

Even when the interest is deductible, you can only deduct interest on up to $750,000 of qualified residence loans (or $375,000 if married filing separately). This limit includes your primary mortgage too.

Record Keeping Requirements

If you want to claim the deduction, you need solid documentation of how the HELOC funds were used. Save receipts, contracts, and other proof that the money went toward home improvements.

The IRS can request these records during an audit, and without them, your deduction might be disallowed.

HELOC Payment Strategies

How you manage your HELOC payments can significantly impact your financial health and how much interest you ultimately pay.

Interest-Only vs. Principal Payments

During the draw period, you typically have the option to make interest-only payments. While this minimizes your monthly obligation, it means you’re not reducing your principal at all.

If you have the means, making principal payments during the draw period can save you thousands in interest and reduce payment shock when the repayment period begins.

Payment Frequency Options

Many lenders allow bi-weekly or even weekly payment options instead of monthly payments.

Making half your payment every two weeks results in 26 half-payments per year—equivalent to 13 monthly payments instead of 12. This simple change can save substantial interest over time.

Prepayment Considerations

Unlike some loans, most HELOCs don’t have prepayment penalties. This means you can pay extra or even pay off the entire balance without fees.

If you come into unexpected money—a bonus, tax refund, or inheritance—consider putting some toward your HELOC balance.

Common Uses for HELOCs

While you can use a HELOC for almost anything, some uses make more financial sense than others.

Home Improvements

This is perhaps the most common and financially sound use of a HELOC. Home improvements can increase your property value, potentially making this a self-funding strategy in the long run.

Plus, as mentioned earlier, this is the only use that preserves tax deductibility of the interest.

Debt Consolidation

Using a HELOC to pay off high-interest debt like credit cards can save money on interest and simplify your finances with one payment instead of many.

Just be cautious—you’re converting unsecured debt (credit cards) to secured debt (HELOC). If you can’t make payments, your home is now at risk.

Emergency Fund Alternative

Some financial advisors suggest a HELOC as a backup emergency fund. The line is there if you need it, but you’re not paying interest on unused funds.

This strategy requires discipline—a HELOC isn’t a replacement for actual savings, just a backup plan.

Educational Expenses

College tuition, trade school, or other educational pursuits are common HELOC uses. The rates are often lower than student loans, though you lose certain protections specific to student loans.

Remember that interest used this way isn’t tax-deductible like it would be with actual student loans.

Risks and Considerations

HELOCs come with significant potential downsides that every borrower should understand before signing up.

Foreclosure Risk

This is the biggest risk with any home-secured debt. If you can’t make your HELOC payments, the lender can foreclose on your home—even if you’re current on your primary mortgage.

Never borrow against your home unless you’re confident in your ability to repay, regardless of potential economic changes or personal circumstances.

Interest Rate Uncertainty

The variable nature of HELOC rates means your payments could increase substantially if rates rise. A HELOC that’s affordable today might strain your budget if rates jump 2-3 percentage points.

Consider the worst-case scenario: Could you still make payments if your rate hit the lifetime cap?

Frozen or Reduced Credit Lines

During the 2008 housing crisis, many lenders froze or reduced HELOC limits, even for borrowers in good standing. This can happen when:

- Home values decline significantly

- Your credit score drops

- The lender faces financial challenges

This risk is particularly problematic if you’re counting on HELOC funds for ongoing projects or planned expenses.

Home Value Fluctuations

If your home’s value drops, you could end up underwater—owing more than your home is worth when combining your mortgage and HELOC.

This makes selling difficult and can trap you in your home until values recover or you can pay down enough debt.

HELOC Alternatives

Before committing to a HELOC, it’s worth considering other options that might better suit your specific needs.

Cash-Out Refinance

Instead of adding a second loan, a cash-out refinance replaces your existing mortgage with a larger one and gives you the difference in cash.

This option makes sense when current mortgage rates are lower than your existing rate, but it typically comes with higher closing costs than a HELOC.

Home Equity Loan

Unlike a HELOC’s revolving line of credit, a home equity loan provides a one-time lump sum with a fixed interest rate and fixed monthly payments.

This option provides more payment certainty and might be better if you need all the funds at once for a specific project with a known cost.

Personal Loans

Unsecured personal loans don’t use your home as collateral, eliminating foreclosure risk. They typically have:

- Higher interest rates than HELOCs

- Fixed terms (usually 3-7 years)

- No closing costs

For smaller amounts or shorter terms, personal loans might actually cost less overall despite the higher rate.

0% APR Credit Cards

For short-term financing needs, credit cards with promotional 0% APR periods (often 12-18 months) can be more economical than a HELOC.

This works best for smaller expenses you’re confident you can pay off before the promotional period ends.

The Application Process

If you decide a HELOC is right for you, here’s what to expect during the application process.

Documentation Requirements

Be prepared to provide:

- Proof of income (W-2s, tax returns, pay stubs)

- Property information (deed, tax statements)

- Mortgage statements

- Asset documentation (bank statements, investment accounts)

- Photo ID

Lenders typically want two years of income history and recent statements for all financial accounts.

Home Appraisal

Most HELOC applications require a professional appraisal to determine your home’s current market value. Sometimes lenders use automated valuation models instead, especially for smaller amounts.

The appraisal cost ($300-600) is usually your responsibility, though some lenders absorb this as part of promotions.

Approval Timeline

From application to funding, the HELOC process typically takes 2-6 weeks. This is faster than most primary mortgages but still not immediate.

If you need funds by a specific date (like for a scheduled renovation), apply at least two months in advance.

Closing Process

HELOC closings are less formal than mortgage closings. Sometimes you can complete the process entirely online or via mail.

You’ll sign a pile of documents including:

- HELOC agreement

- Truth in Lending disclosures

- Notice of right to cancel (giving you 3 business days to change your mind)

Managing Your HELOC Effectively

Once your HELOC is established, good management practices will help you maximize its benefits while minimizing risks.

Regular Monitoring

Check your HELOC statement monthly, even during periods when you’re not actively using it. Keep an eye on:

- Current interest rate

- Available credit

- Any fees charged

- Payment allocation (how much goes to principal vs. interest)

Most lenders offer online access and mobile apps that make monitoring simple.

Draw Period Strategy

During the draw period, consider these strategies:

- Borrow only for planned expenses, not impulse purchases

- Make more than minimum payments when possible

- Track how funds are used for tax purposes

- Consider principal reductions before the repayment period begins

Remember that every dollar you borrow against your home puts that home at risk.

Preparing for Repayment

The transition from draw period to repayment period can be jarring if you’re not prepared. In the year before repayment begins:

- Estimate your new monthly payment

- Practice making this payment by setting aside the difference

- Consider refinancing options if the payment will be unmanageable

- Reduce other debts to free up cash flow

Some borrowers choose to refinance their HELOC and primary mortgage into a single loan before the repayment period starts.

Making the Most of Your HELOC

Used wisely, a HELOC can be a powerful financial tool that builds wealth rather than draining it.

Strategic Borrowing

The best HELOC uses tend to either:

- Increase your asset values (home improvements)

- Reduce higher-cost debt (consolidation)

- Fund investments with higher returns than the HELOC cost

Avoid using your HELOC for depreciating assets like cars or vacations unless absolutely necessary.

Leveraging Tax Benefits

When you use your HELOC for qualifying home improvements, keep detailed records of:

- Contractor invoices

- Material receipts

- Before and after photos

- Permits and inspections

This documentation proves the tax-deductible nature of your HELOC interest.

HELOC as Part of Financial Planning

Incorporate your HELOC into your broader financial plan. Consider how it interacts with:

- Retirement planning

- College funding strategies

- Investment opportunities

- Emergency preparedness

A financial advisor can help integrate your HELOC into your overall financial picture.

HELOCs are complex financial products with significant benefits and serious risks. Understanding how they work is essential before tapping into what might be your most valuable asset—your home.

Qualifying for a HELOC

Understanding the Basics of Qualification

Getting a Home Equity Line of Credit isn’t like picking up milk at the store. Lenders need to make sure you’re a safe bet before they hand over access to potentially tens of thousands of dollars.

Think about it – they’re basically giving you a credit card that uses your house as collateral. Pretty serious stuff.

So what do lenders look at when deciding if you qualify? It boils down to four main things: equity, credit score, income, and debt levels. Let’s break these down in real-world terms.

How Much Equity Do You Actually Need?

Equity is king in the HELOC world. It’s the difference between what your home is worth and what you still owe on your mortgage.

Most lenders want to see at least 15-20% equity remaining after your HELOC. That means if your home is worth $300,000, and you have a $200,000 mortgage balance, you’ve got $100,000 in equity. But lenders typically won’t let you borrow all of that.

Here’s a quick example:

- Home value: $300,000

- Current mortgage: $200,000

- Total equity: $100,000

- Maximum combined loan-to-value (CLTV) ratio: 80-85%

- Maximum total borrowing: $240,000-$255,000

- Current mortgage: $200,000

- Maximum HELOC amount: $40,000-$55,000

Some lenders might go up to 90% CLTV, especially if you have stellar credit. Others might cap it at 80% if they’re being conservative. Shop around – those percentage points make a big difference in how much you can borrow.

Credit Score Requirements – The Real Deal

Your credit score tells lenders how you’ve handled debt in the past. For HELOCs, most lenders look for a FICO score of at least 620, but that’s just scraping by.

The truth? With a 620 score, you’ll get approved, but your rate will be so high you might regret it. The sweet spot is 740+ – that’s where you unlock the best rates.

Here’s what different credit score ranges might mean for your HELOC:

| Credit Score Range | Likely Outcome |

|---|---|

| Below 620 | Difficult to get approved; consider improving your score first |

| 620-680 | Possible approval but with higher interest rates |

| 681-740 | Good chances of approval with competitive rates |

| 741+ | Best rates and terms available |

If your score isn’t great, consider waiting a few months. Pay down credit card debt, make on-time payments, and dispute any errors on your credit report. A 30-point boost could save you thousands over the life of your HELOC.

Income Verification – What Lenders Really Want to See

Lenders need proof you can handle the monthly payments. But it’s not just about how much you make – it’s about stability.

Two years of steady income is the gold standard. If you’ve job-hopped or just started a business, lenders get nervous. They’ll typically ask for:

- Two years of tax returns

- Recent pay stubs

- W-2s or 1099s

- Profit and loss statements (if self-employed)

Self-employed borrowers face extra scrutiny. Lenders often average your last two years of income, which can be tricky if you had a great year followed by a slower one. Some lenders will also discount your self-employment income by 15-25% just to be safe.

Working a side gig for extra cash? That income usually only counts if you’ve been doing it consistently for two years and can document it on your tax returns.

Debt-to-Income Ratio – The Number That Can Make or Break You

Your debt-to-income (DTI) ratio measures your monthly debt payments against your gross monthly income. It’s expressed as a percentage, and lower is definitely better.

Most HELOC lenders cap DTI at 43%, but some go as high as 50% if other aspects of your application are strong.

Let’s say your household brings in $8,000 monthly before taxes. Here’s how the math works:

- Current mortgage payment: $1,500

- Auto loan: $400

- Student loans: $300

- Credit card minimums: $200

- Potential HELOC payment: $400

- Total monthly debt: $2,800

- DTI ratio: 35% ($2,800 ÷ $8,000 = 0.35)

In this scenario, you’re in good shape at 35% DTI.

But watch out – lenders calculate your HELOC payment based on the assumption you’ll max out your credit line. They’ll use the fully-indexed rate plus 2% in many cases, not just the introductory rate you see advertised.

Property Requirements – Not All Homes Qualify

Your house itself needs to meet certain standards too. Most lenders require:

- Primary residence (second homes and investment properties face tougher requirements)

- Single-family home, condo, or townhouse (manufactured homes are trickier)

- No major issues that would affect marketability

Condos face additional scrutiny. If your HOA is in litigation or has too many rentals, you might struggle to get approved regardless of your personal qualifications.

The property value matters too. Most lenders have minimum HELOC amounts of $10,000-$25,000, which means your equity needs to support at least that much borrowing.

The Application Process – What to Expect

Applying for a HELOC isn’t quick, but it’s not as intensive as getting your original mortgage. Here’s what typically happens:

- Pre-qualification – A quick check of credit and basic information

- Application – Submitting financial documents

- Home appraisal – Determining your property’s current value

- Underwriting – Detailed review of your finances

- Closing – Signing the final paperwork

The timeline? Usually 30-45 days from application to funding. The appraisal alone can take 1-2 weeks, especially when real estate markets are hot.

Some online lenders advertise faster timelines, but be skeptical of anything promising approval in days. Quality underwriting takes time.

Common Reasons for HELOC Denial

Getting rejected hurts, but knowing why helps you fix the issues. Common rejection reasons include:

- Insufficient equity (the most common reason)

- Credit score too low

- DTI ratio too high

- Unstable or insufficient income

- Property issues (condition problems, unusual property type)

- Recent bankruptcy or foreclosure

If you’re denied, ask the lender for specifics. They’re required to tell you the main reasons for denial, which gives you a roadmap for what to improve.

Alternative Options If You Don’t Qualify

Can’t get a HELOC? Don’t panic – you’ve got options:

- Home equity loan – Similar requirements but fixed rate and lump sum

- Cash-out refinance – Replace your existing mortgage with a larger one

- Personal loan – No collateral required, but higher interest rates

- Shared equity agreement – Share future appreciation instead of paying interest

- FHA Title I loan – Government-backed home improvement loan

Each has pros and cons. Personal loans offer quick funding but rates can be double what you’d pay for a HELOC. Cash-out refinances might make sense if current rates are lower than your existing mortgage.

How Different Lenders Vary in Requirements

Not all HELOC lenders are created equal. Banks, credit unions, and online lenders all have different priorities:

- Big banks: Generally the strictest requirements but competitive rates

- Credit unions: Often more flexible on credit scores but may have membership requirements

- Online lenders: Can be more innovative with qualification but sometimes charge higher fees

Credit unions typically offer the best combination of reasonable qualification standards and low rates. Their not-for-profit status means they can be more borrower-friendly.

Some online lenders specialize in “non-QM” lending, meaning they don’t follow the strict Qualified Mortgage standards. These lenders might approve you with lower credit scores or higher DTI ratios, but expect to pay for that flexibility with higher rates.

Special Considerations for Self-Employed Borrowers

Working for yourself makes the HELOC process trickier. Lenders get nervous about variable income, so they’ll typically:

- Average your last two years of income (after business deductions)

- Request additional documentation like profit/loss statements

- Look for an upward trend in earnings

- Scrutinize your business stability

The key is showing consistent income despite normal business fluctuations. Having substantial cash reserves can help offset concerns about variable income.

Some lenders offer “bank statement” programs where they base your income on deposits rather than tax returns. These programs can be helpful if you take a lot of deductions that lower your taxable income, but they usually come with higher rates.

Improving Your Chances of Approval

If you’re on the fence for qualification, these strategies can tip the scales in your favor:

Short-term fixes (1-3 months):

- Pay down credit card balances to improve DTI and credit score

- Fix errors on your credit report

- Hold off on other new credit applications

- Gather documentation showing additional income sources

Medium-term improvements (3-12 months):

- Build payment history with on-time payments

- Pay down existing debts

- Save for a larger emergency fund (lenders love to see cash reserves)

- Address minor property issues that might affect appraisal

Long-term strategies (1+ year):

- Wait for property values to increase in your area

- Pay down mortgage principal to build equity faster

- Improve your credit mix with different types of credit

- Establish longer employment history

Sometimes waiting just six months while improving your financial picture can make the difference between denial and approval – or between an okay rate and a great one.

Combined Loan-to-Value Ratio Explained

The combined loan-to-value (CLTV) ratio deserves special attention because it’s often the make-or-break factor.

Your CLTV includes all loans against your property:

- Primary mortgage

- Second mortgages

- The HELOC you’re applying for

- Any other liens against the property

Most lenders cap CLTV at 80-85%, meaning all your home loans combined can’t exceed that percentage of your home’s value.

The formula is simple:

CLTV = (All mortgage balances + HELOC limit) ÷ Home value

For example, if your home is worth $400,000 and you owe $250,000 on your primary mortgage:

- Home value: $400,000

- Mortgage balance: $250,000

- 80% CLTV limit: $320,000

- Maximum HELOC amount: $70,000 ($320,000 – $250,000)

Even if your income and credit are perfect, you can’t exceed these CLTV limits with most conventional lenders.

The Impact of Interest Rate Environment

Interest rates affect HELOCs in two major ways:

- Qualification standards: When rates rise, lenders often tighten requirements

- Payment calculations: Higher rates mean higher potential payments, affecting DTI

When the Federal Reserve raises rates, HELOC rates follow because they’re typically tied to the prime rate. This means the DTI calculations will assume higher payments, potentially pushing some borrowers outside qualification limits.

During times of economic uncertainty, lenders also tend to lower CLTV limits – maybe from 85% to 80% – to reduce their risk. This directly impacts how much you can borrow.

The best time to get a HELOC is usually when rates are stable or declining and property values are rising. But life doesn’t always let you time things perfectly.

HELOC vs. Home Equity Loan Qualification Differences

While similar, there are subtle differences in qualifying for these two products:

| Factor | HELOC | Home Equity Loan |

|---|---|---|

| Credit Score | Often requires higher scores (680+) | May accept scores from 620+ |

| DTI Calculation | Based on potential full draw at indexed rate | Based on fixed payment amount |

| Income Stability | Greater emphasis on stability | Slightly more flexible |

| CLTV Limits | Typically 80-85% | Sometimes allows up to 90% |

| Property Types | More restrictive | More flexible with non-traditional homes |

Home equity loans sometimes have slightly easier qualification standards because they’re less risky for lenders – the payment is fixed and predictable rather than variable.

How to Prepare for the Application

Preparation makes a huge difference in both approval odds and how smoothly the process goes. Before applying:

- Check your credit reports from all three bureaus and fix any errors

- Calculate your own DTI to see where you stand

- Estimate your home’s value using online tools like Redfin or Zillow

- Organize your financial documents:

- Two years of tax returns

- Recent pay stubs

- Bank statements

- Homeowners insurance information

- Mortgage statements

- Research current HELOC rates to know what’s competitive

- Consider paying down debts strategically to improve DTI

Many lenders offer pre-qualification tools on their websites. These soft credit pulls can give you a good idea of whether you’ll qualify without affecting your credit score.

The Power of Shopping Around

Different lenders have different appetites for risk. Where one lender might deny you, another might approve with similar terms.

Credit unions especially tend to have more flexible standards than big banks. Some even offer HELOC products specifically designed for borrowers with lower credit scores or higher DTI ratios.

Get quotes from at least three different types of lenders:

- A national bank

- A local credit union

- An online lender

Beyond approval odds, comparing offers can save you thousands. Even a 0.5% difference in rate adds up substantially over time on a large credit line.

Pay attention to more than just the rate – look at:

- Annual fees

- Origination fees

- Early termination fees

- Draw period length

- Minimum draw requirements

Special Programs and Exceptions

Some lenders offer special programs that might help you qualify:

- First-time HELOC programs with more flexible requirements

- Professional programs for doctors, lawyers, and other high-income professionals that allow higher DTI ratios

- Community reinvestment programs in certain geographic areas

- Relationship discounts if you have other accounts with the lender

If you’re struggling to qualify, ask specifically about alternative programs. Sometimes just having substantial deposits with the lender can overcome a borderline application.

The Importance of Timing Your Application

The real estate market and broader economy affect HELOC approval standards. During housing booms, lenders get more comfortable with higher CLTVs. During downturns, they get more conservative.

Similarly, your personal timing matters. If you’re about to:

- Change jobs

- Make a major purchase

- Apply for other credit

…consider how that might affect your HELOC application. Even getting a new car loan the month before applying could change your DTI enough to affect approval.

The ideal time to apply is when:

- You’ve been at your job 2+ years

- Your credit score is at its highest

- Your debts are at their lowest

- You haven’t applied for other credit recently

- Home values in your area are stable or rising

Understanding the Draw and Repayment Periods

Qualifying for a HELOC means understanding how the draw and repayment periods affect your finances.

During the draw period (typically 10 years), you can borrow and repay repeatedly, usually making interest-only payments. But once the repayment period hits (typically 20 years), you can’t borrow anymore and must repay principal plus interest.

This payment jump can be substantial. A $50,000 balance might have interest-only payments around $200/month during the draw period, but jump to $400/month or more during repayment.

Lenders know this payment shock is risky, so they qualify you based on the higher, fully-amortized payment – even though you won’t pay that initially.

The Bottom Line on Qualifying

Qualifying for a HELOC comes down to demonstrating that:

- You have sufficient equity (CLTV usually 80-85%)

- Your credit is reliable (typically 620+ minimum, 740+ for best rates)

- Your income is stable and sufficient (two-year history preferred)

- Your debt levels are manageable (DTI under 43% in most cases)

- Your property meets standards (primary residence in good condition)

No single factor will necessarily make or break your application. Strength in one area can sometimes offset weakness in another – especially if you’re working with a lender who manually underwrites loans rather than relying solely on automated systems.

Remember that lending standards change with economic conditions. What was an easy approval last year might be a stretch today, and vice versa. Stay flexible, be prepared to shop around, and don’t take rejection from one lender as the final word.

Variable interest rate

Understanding Variable Interest Rates for HELOCs

When you’re considering a home equity line of credit, the interest rate structure is one of the most critical factors that will affect how much you’ll pay over time. Most HELOCs come with variable interest rates, which means your payment can change—sometimes dramatically—over the life of your loan.

Variable rates don’t stay put. They dance around based on broader economic conditions, which can either work in your favor or against it depending on market timing.

How Variable Rates Work

Variable rates on HELOCs are typically tied to a benchmark rate, usually the prime rate. The prime rate is what banks charge their most creditworthy customers, and it’s directly influenced by the Federal Reserve’s federal funds rate.

Your HELOC rate is typically calculated as the prime rate plus a margin. For example, if the prime rate is 5% and your margin is 1%, your HELOC rate would be 6%.

Here’s the kicker—when the prime rate changes, so does your HELOC rate. And that happens without any input from you. You’re along for the ride whether you like it or not.

The Impact of Rate Changes on Your Payment

Think about what happens to your monthly payment when rates tick up. Let’s say you have a $50,000 HELOC balance with an interest-only payment period. If your rate jumps from 6% to 7%, your monthly payment would increase from $250 to $292. That’s an extra $42 a month or $504 per year.

Small rate changes can add up to big dollars over time. And if rates spike quickly, you could find yourself in a tough spot financially.

The Historical Context of HELOC Rates

Looking back over the past few decades, HELOC rates have seen significant swings. During the 2008 financial crisis, many homeowners with HELOCs watched in horror as their rates climbed rapidly, leading to payment shock for many households.

More recently, we saw historically low rates during the COVID-19 pandemic, but since 2022, the Federal Reserve has been aggressively raising rates to combat inflation. Many HELOC borrowers who took out loans during the low-rate environment are now facing higher payments.

History tells us that rates will continue to fluctuate. The question isn’t if your rate will change, but when and by how much.

Pros and Cons of Variable-Rate HELOCs

Pros

Lower initial rates: Variable-rate HELOCs often start with lower rates than fixed-rate options, making them attractive for short-term borrowing.

Potential for rate decreases: If market rates fall, your HELOC rate may decrease too, reducing your payment.

Flexibility: Variable-rate HELOCs typically offer more flexibility in terms of draw periods and payment options.

Cons

Payment uncertainty: Your monthly payment can change, making it harder to budget.

Risk of significant increases: If rates rise substantially, your payment could become unaffordable.

Complexity: Understanding how variable rates work and how they might impact your finances requires some financial literacy.

Rate Caps and Floors

Some HELOCs come with rate caps, which limit how much your rate can increase during a specific period or over the life of the loan. These caps serve as guardrails, protecting you from extreme rate spikes.

For example, a HELOC might have:

- A periodic cap that limits increases to 2% in any one year

- A lifetime cap that prevents the rate from ever exceeding a certain percentage, like 18%

Rate floors work in the opposite direction, setting a minimum rate regardless of how low the prime rate goes. This protects the lender if rates plummet.

Always check if your HELOC has caps and floors, and understand exactly how they work. These features can significantly impact the long-term cost of your loan.

Rate Change Frequency

HELOCs don’t all adjust at the same pace. Some might change rates monthly, while others adjust quarterly or annually. The more frequent the adjustment, the more closely your rate will track with current market conditions.

Less frequent adjustments might provide more short-term stability but could mean larger jumps when changes do occur.

Comparing Variable vs. Fixed-Rate HELOCs

Some lenders offer fixed-rate conversion options, allowing you to lock in a portion or all of your balance at a fixed rate. This can provide peace of mind if you’re concerned about rising rates.

Here’s how they stack up:

| Feature | Variable-Rate HELOC | Fixed-Rate HELOC |

|---|---|---|

| Initial rate | Generally lower | Generally higher |

| Payment predictability | Low | High |

| Risk if rates rise | High | None |

| Benefit if rates fall | Yes | No |

| Flexibility | High | Lower |

Strategies for Managing Variable Rate Risk

Smart borrowers have a plan for handling rate increases. Here are some approaches to consider:

Make principal payments during the draw period: Even if you’re only required to make interest payments, paying down principal reduces your exposure to rate increases.

Set up a rate alert: Many financial websites allow you to set alerts for when the prime rate changes, giving you time to adjust your budget.

Maintain a buffer in your budget: If possible, leave room in your monthly budget to absorb potential rate increases.

Consider conversion options: If your lender offers the ability to convert to a fixed rate, know the terms and conditions ahead of time.

Refinance when appropriate: If rates are rising and you have a large HELOC balance, consider refinancing into a fixed-rate loan.

Rate Shopping and Negotiation

Not all variable-rate HELOCs are created equal. Lenders have discretion in setting the margin above the prime rate, and this is where shopping around can save you serious money.

A difference of just 0.5% in the margin can save thousands over the life of a HELOC. For instance, on a $100,000 HELOC with a 10-year draw period and 20-year repayment period, a 0.5% lower rate could save you over $10,000 in interest.

Don’t be afraid to negotiate. If you have excellent credit, substantial equity, and a strong income, you have leverage to ask for a better rate.

Reading the Fine Print

Before signing on the dotted line, understand all the details about how your variable rate works:

- How often can the rate adjust?

- Is there a minimum payment increase?

- Are there rate caps or floors?

- How much notice will you receive before a rate change?

- Are there fees associated with rate changes?

The answers to these questions might be buried in the loan agreement, but they’re crucial to understanding your risk.

Real-World Impact of Variable Rates

Let’s look at a real-world scenario to understand the impact of variable rates.

Imagine you take out a $75,000 HELOC with an initial rate of 6% (prime rate of 5% plus a 1% margin). Your minimum monthly payment during the interest-only draw period would be $375.

Now, let’s say the Federal Reserve raises rates over the next two years, pushing the prime rate to 7%. Your HELOC rate would increase to 8%, and your monthly payment would jump to $500—a 33% increase in your payment.

That’s an extra $1,500 per year just in interest. And if rates continue to rise, so would your payment.

Variable Rates in Different Economic Environments

The impact of a variable rate depends largely on the broader economic environment:

Rising rate environment: As we’ve seen since 2022, when the Fed fights inflation with rate hikes, HELOC borrowers face increasing payments.

Stable rate environment: During periods of economic stability, your HELOC rate might remain relatively steady, offering predictable payments.

Falling rate environment: When the economy slows and the Fed cuts rates, HELOC borrowers benefit from lower payments without having to refinance.

Understanding the current economic cycle and Fed policy can help you time your HELOC application for more favorable terms.

Consumer Protections for Variable-Rate Loans

Following the 2008 financial crisis, regulators implemented stronger consumer protections for home equity products. The Truth in Lending Act (TILA) requires lenders to clearly disclose how variable rates work and the potential impact on payments.

Lenders must provide you with:

- Historical examples of how rate changes would have affected payments

- Information about rate caps

- The maximum possible payment under worst-case scenarios

These disclosures aren’t just paperwork—they’re valuable tools for assessing the risk of a variable-rate HELOC.

Variable Rates and Tax Deductibility

The tax implications of HELOC interest can be complicated, especially with changing tax laws. As of my last update, HELOC interest is only deductible when used for home improvements, and the deduction is subject to limits.

A variable rate could affect your tax planning because the amount of potentially deductible interest will change year to year. Consult a tax professional about how HELOC interest might impact your specific tax situation.

The Psychological Impact of Variable Rates

There’s a psychological aspect to variable rates that’s often overlooked. Some borrowers experience significant stress watching rates climb, even if they can afford the payments.

This anxiety can affect quality of life and even lead to poor financial decisions made out of fear. Before choosing a variable-rate HELOC, honestly assess your risk tolerance and comfort with uncertainty.

Alternative Rate Structures

If you’re uncomfortable with fully variable rates, ask about alternative structures:

Hybrid HELOCs: Some lenders offer products that combine fixed and variable rates, giving you more stability for a portion of your borrowing.

Capped variable rates: These HELOCs have stricter caps on how much rates can increase, providing more predictability.

Convertible HELOCs: These allow you to switch from variable to fixed rates during the draw period, typically for a fee.

Each alternative has its own pros and cons, but they might provide a middle ground between fully variable and fixed-rate products.

Long-Term Planning with Variable Rates

If you opt for a variable-rate HELOC, incorporate it into your long-term financial planning:

- How will you handle a significant rate increase?

- What’s your exit strategy if rates rise too much?

- How does the HELOC fit into your retirement planning?

- Will you still be able to meet other financial goals if payments increase?

A variable-rate HELOC is a long-term commitment—most have 30-year terms—so thinking decades ahead is necessary.

Making an Informed Decision

At the end of the day, a variable-rate HELOC can be an excellent financial tool when used appropriately and with a full understanding of the risks.

The key is making an informed decision based on:

- Your financial situation and stability

- Your ability to absorb higher payments

- Your planned use of the funds

- Your timeline for repayment

- Current economic conditions and rate forecasts

Variable rates offer flexibility and often lower initial costs, but they come with uncertainty that not every borrower is equipped to handle.

By thoroughly understanding how variable rates work and preparing for potential changes, you can harness the benefits of a HELOC while minimizing the risks. Remember, the most expensive loan is the one you don’t fully understand before signing.

Fixed interest rate option

Understanding Fixed Interest Rate Options for HELOCs

While traditional home equity lines of credit typically come with variable interest rates, many lenders now offer fixed-rate options to provide stability in your borrowing costs. This feature can be a game-changer if you’re worried about interest rate fluctuations affecting your monthly payments.

Think about it this way: with a variable rate, your payment could change every month. With a fixed rate, you lock in your interest rate for a specific period. The predictability makes budgeting much easier.

How Fixed-Rate Options Work With HELOCs

Fixed-rate options for HELOCs work differently than simply having a fixed-rate loan from the start. Here’s the breakdown:

With a standard HELOC, you have a draw period (typically 10 years) where you can borrow money as needed, followed by a repayment period (usually 20 years) when you can no longer borrow and must repay what you’ve used.

The fixed-rate option allows you to take a portion of your available credit line and lock it in at a fixed interest rate for a set term. Meanwhile, the rest of your HELOC balance can remain at the variable rate.

For example, if you have a $100,000 HELOC and need $30,000 for a kitchen renovation, you could convert that $30,000 to a fixed rate while keeping the remaining $70,000 available at the variable rate.

Benefits of Choosing a Fixed-Rate Option

1. Payment Predictability

When interest rates are climbing (like they have been recently), locking in a portion of your HELOC at a fixed rate means your monthly payment won’t increase if market rates continue to rise.

“I converted $50,000 of my HELOC to a fixed rate last year,” says Mike, a homeowner from Colorado. “My neighbors who didn’t are now paying almost $200 more per month because of rate hikes.”

2. Budget Planning

With a fixed-rate portion, you’ll know exactly how much your payments will be for the duration of the term. This predictability makes it easier to manage your household budget without worrying about payment fluctuations.

3. Protection Against Rising Rates

If you believe interest rates will increase in the future, converting to a fixed rate now could save you thousands over the life of your loan.

Let’s compare:

A $25,000 balance at a 5% variable rate might cost you $131 per month in interest-only payments. If rates rise to 7%, your payment jumps to $184 monthly. That’s over $600 more per year just in interest!

4. Multiple Fixed-Rate Options

Many lenders allow you to have several fixed-rate portions at once. This means you can take out money for different projects at different times and lock each portion at the rate available when you need the funds.

When to Consider Fixed-Rate Conversion

During Rising Interest Rate Environments

When the Federal Reserve is in a rate-hiking cycle, converting variable-rate debt to fixed rates can be a smart move. If you’ve been watching rates climb quarter after quarter, locking in before the next increase could save you money.

For Long-Term Projects

If you’re planning to carry the debt for several years—like for college tuition payments or a major home renovation—fixing the rate makes the long-term cost more predictable.

When You Need Payment Stability

If you’re on a fixed income or have a tight monthly budget, the certainty of fixed payments might be worth even a slightly higher interest rate.

Drawbacks of Fixed-Rate Options

Potentially Higher Initial Rates

Fixed-rate options usually come with higher initial interest rates than the variable rate. You’re paying a premium for that stability.

For instance, if the variable HELOC rate is 5.25%, the fixed-rate option might start at 5.75% or higher. You’re essentially paying for insurance against future rate increases.

Conversion Fees

Some lenders charge a fee every time you convert a portion of your HELOC to a fixed rate. These fees typically range from $50 to $100 per conversion.

Less Flexibility

Once you convert to a fixed rate, that portion of your credit line becomes a term loan. You’ll need to make regular principal and interest payments, unlike the interest-only payment option that might be available during the draw period of a variable-rate HELOC.

How to Convert to a Fixed Rate

The process varies by lender, but typically involves:

- Contacting your lender directly

- Specifying how much of your HELOC balance you want to convert

- Agreeing to the fixed interest rate and term

- Signing modified loan documents

Many banks allow you to make this conversion through online banking, by phone, or at a branch location.

Fixed-Rate HELOC vs. Traditional Home Equity Loan

It’s worth understanding the difference between a fixed-rate HELOC option and a traditional home equity loan:

| Feature | Fixed-Rate HELOC Option | Traditional Home Equity Loan |

|---|---|---|

| Funding | Take only what you need when you need it | Lump-sum upfront |

| Rate structure | Portion of credit line fixed, rest variable | Entirely fixed from the start |

| Flexibility | Can have multiple fixed portions | One loan, one rate |

| Additional draws | Remaining credit line still available | Need a new loan for additional funds |

| Payment terms | Often 5-20 years for fixed portions | Typically 5-30 years |

Real-World Example of Fixed-Rate Savings

Take the case of Sarah, who took out a $100,000 HELOC in 2020 when the prime rate was at historic lows. She initially borrowed $40,000 at a variable rate of prime plus 1% (around 4.25% total).

As rates started climbing in 2022, Sarah converted her $40,000 balance to a fixed rate of 5% for 10 years. While this was higher than her initial rate, it protected her from subsequent rate hikes.

By mid-2023, the prime rate had risen to 8.5%, meaning her variable rate would have been around 9.5%. By converting to a fixed rate, Sarah now saves about $150 per month in interest charges—that’s $1,800 annually and $18,000 over the 10-year term.

Questions to Ask Your Lender About Fixed-Rate Options

Before committing to a fixed-rate option, ask your lender these critical questions:

- What fixed rates are currently available?

- Is there a fee to convert to a fixed rate?

- How many fixed-rate portions can I have simultaneously?

- What terms (length of loan) are available for fixed-rate portions?

- Can I convert back to a variable rate if interest rates drop?

- Is there a minimum amount required for fixed-rate conversion?

- Will my payment include principal and interest, or interest only?

- Are there prepayment penalties for paying off fixed-rate portions early?

Making the Decision: Fixed or Variable?

The decision between variable and fixed rates ultimately comes down to your personal financial situation, risk tolerance, and market outlook.

Ask yourself:

- How long do I plan to carry this debt?

- Can my budget handle potential payment increases if rates rise?

- What’s my outlook on interest rate trends?

- How important is payment predictability to me?

The good news is you don’t have to choose exclusively between fixed and variable—you can use both strategies with a HELOC that offers fixed-rate options.

Strategies for Using Fixed-Rate Options Effectively

The “Ladder” Approach

Some homeowners create a “ladder” of fixed-rate portions with different maturity dates. This strategy spreads out the risk of locking in at a high rate and provides flexibility for refinancing as portions mature.

For example, you might convert:

- $20,000 to a 5-year fixed term

- $30,000 to a 10-year fixed term

- $15,000 to a 15-year fixed term

This way, you’ll have portions of your debt becoming “free” at different times, allowing you to reassess rates and your financial needs.

The “Major Purchase” Strategy

Only convert to fixed rates for substantial expenses you know you’ll be paying off over time, like college tuition or a home renovation. Keep smaller, more temporary expenses on the variable rate portion.

The “Wait and See” Approach

Keep your HELOC at a variable rate initially, then monitor interest rate trends. If rates start climbing, you can convert to a fixed rate before they go too high.

This strategy didn’t work well for those who waited too long in 2022, as rates rose rapidly, but in more stable environments, it can help you avoid paying the fixed-rate premium unnecessarily.

Common Misconceptions About Fixed-Rate HELOCs

“Converting to a fixed rate will lower my interest rate.”

The reality: Fixed-rate options typically start at a rate higher than the current variable rate. You’re paying for stability, not necessarily an immediate reduction in rate.

“Once I convert to a fixed rate, I can’t access that money again.”

The reality: True, that portion becomes a term loan. However, as you pay down the principal, your available credit line increases again, allowing you to reborrow against it (at the current variable rate).

“I can only convert once during my HELOC term.”

The reality: Most lenders allow multiple conversions, letting you create several fixed-rate portions over time.

Market Conditions and Fixed-Rate Considerations

The Federal Reserve’s monetary policy heavily influences HELOC rates. When the Fed is raising rates to combat inflation, variable-rate HELOCs become more expensive quickly.

During these periods, fixed-rate conversions become particularly attractive, even if they start slightly higher than your current variable rate.

Conversely, if economic indicators suggest the Fed may start cutting rates, you might want to stay with a variable rate to benefit from future decreases.

The Impact of Your Credit Score

Your credit score significantly affects the fixed rates you’ll be offered. Lenders typically reserve their best rates for borrowers with scores above a specific threshold (often 740 or higher).

If your credit score has improved significantly since you opened your HELOC, you might qualify for better fixed-rate options than you expected. On the other hand, if your score has decreased, the fixed rates offered might be higher than advertised rates.

Fixed-Rate HELOC Features by Major Lenders

While specific offerings change frequently, here’s how some major lenders structure their fixed-rate options:

- Bank of America: Offers fixed-rate conversion with multiple terms available (5-30 years)

- Chase: Allows up to three fixed-rate advances simultaneously

- Wells Fargo: Provides what they call “rate locks” on portions of your HELOC

- TD Bank: Offers fixed-rate “home equity loans” that draw from your HELOC

- Citibank: Features “interest rate lock” options during the draw period

Each bank has different minimum amounts, maximum numbers of conversions, and fee structures. Shopping around can reveal significant differences in these features.

The Application Process for Fixed-Rate Conversion

Converting a portion of your HELOC to a fixed rate is typically much simpler than applying for the original HELOC. Usually, there’s no new application, no credit check, no appraisal, and minimal paperwork.

Many lenders allow you to make the conversion online or through their mobile app in just a few clicks. Others might require a phone call or visit to a branch.

The simplicity of this process is one of the major advantages of fixed-rate HELOC options compared to refinancing or taking out a separate home equity loan.

Real-World Fixed-Rate Conversion Example

Let’s walk through a typical fixed-rate conversion:

- Maria has a $150,000 HELOC with a current variable rate of 6.25%

- She’s used $75,000 so far and wants to lock in $50,000 at a fixed rate

- She logs into her online banking portal and selects the fixed-rate conversion option

- The system offers her terms of 5, 10, 15, or 20 years with rates ranging from 6.75% to 7.5%

- She selects a 10-year term at 7% and completes the electronic signature process

- The conversion takes effect immediately, creating two portions of her HELOC:

- $50,000 at a fixed 7% for 10 years

- $25,000 remaining at the variable 6.25% rate

- $75,000 still available for future borrowing at the variable rate

Maria now has a blended payment: her fixed-rate portion requires principal and interest payments of about $580 monthly, while her variable portion requires an interest-only minimum payment of about $130, for a total monthly payment of $710.

Tax Considerations for Fixed-Rate HELOC Portions

The Tax Cuts and Jobs Act of 2017 changed the rules for HELOC interest deductibility. Now, interest is only deductible if the funds are used for home improvements, and there are limits on the amount of debt eligible for the deduction.

Converting to a fixed rate doesn’t change these rules. What matters is how you use the money, not whether the interest rate is fixed or variable.

Keep detailed records of how you spend HELOC funds, especially if you’re planning to claim interest deductions.

The Psychology of Fixed vs. Variable Rates

There’s a significant psychological component to choosing between fixed and variable rates. Research shows that most people have a strong preference for certainty, even if it costs them more. This is known as “uncertainty aversion” in behavioral economics.

While paying a premium for a fixed rate might not always be the mathematically optimal choice, the peace of mind it provides can be worth it for many homeowners. Knowing exactly what your payment will be for years to come eliminates a source of financial stress.

Final Thoughts on Fixed-Rate HELOC Options

The fixed-rate option on a HELOC represents the best of both worlds for many homeowners. You get the flexibility of a line of credit combined with the stability of fixed-rate financing when you need it.

In today’s uncertain interest rate environment, having this option in your financial toolkit provides valuable flexibility. You can adapt your borrowing strategy as your needs change and as market conditions evolve.

Remember that the ideal approach often involves a mix of fixed and variable rate debt, tailored to your specific financial situation, risk tolerance, and future plans.

Homeowner tip:

What can a HELOC help you do?

A home equity line of credit isn’t just a fancy financial term – it’s a powerful tool that can transform your financial situation and help you accomplish major life goals. Unlike a traditional loan that gives you a lump sum, a HELOC works more like a credit card, letting you borrow what you need, when you need it, up to your approved limit.

Home Improvements and Renovations

The kitchen with the peeling laminate countertops? The bathroom with the 1970s tile? Your HELOC can fix that.

Home improvements are the most popular use for HELOCs, and for good reason. When you upgrade your home, you’re not just making it more comfortable – you’re potentially increasing its value too.

Think about it: that $30,000 kitchen remodel might boost your home’s value by $20,000 or more. The bathroom renovation that costs $15,000 could return most of that investment when you sell.

The beauty of using a HELOC for renovations is the flexibility. Started a kitchen remodel and discovered water damage behind the walls? No problem – you can access additional funds without applying for a new loan. Planning to do projects in phases? Perfect – just borrow what you need for each stage.

Some homeowners even use HELOCs to build additions, finishing basements, or adding mother-in-law suites. These big-ticket improvements can significantly increase your living space and your home’s market value.

Debt Consolidation

Credit card debt crushing your monthly budget? A HELOC might be your escape hatch.

The average credit card interest rate hovers around 20% or higher. Meanwhile, HELOC rates typically range from 7-10%. That’s a massive difference that could save you thousands.

Let’s break it down with real numbers:

Say you have $25,000 in credit card debt at 22% interest. Your minimum payments are eating you alive, and you’re barely making a dent in the principal.

If you used a HELOC at 8% to pay off those cards, you could potentially:

- Lower your monthly payment

- Save over $3,500 in interest in the first year alone

- Have a clear payoff date instead of decades of minimum payments

The math is compelling, but there’s a serious warning here: using your home to pay off unsecured debt means you’re converting that debt to secured debt. If you fail to make payments on your HELOC, your home is at risk. So this strategy works best for disciplined borrowers who are committed to not running up new credit card balances.

Education Costs

College isn’t getting any cheaper. The average cost for a four-year degree can easily exceed $100,000 at public universities and double that at private schools.

A HELOC offers a flexible way to fund education costs:

- You can draw funds as needed semester by semester

- Interest rates are typically lower than many student loans

- You might be able to deduct the interest on your taxes (consult your tax advisor)

Parents often use HELOCs to bridge financial aid gaps or pay for expenses not covered by scholarships. It can also be a good option for graduate school or professional degrees where federal student loan options may be more limited.

The risk, again, is putting your home on the line for education debt. But for many families, the flexibility of a HELOC makes it a valuable tool in the college funding toolkit.

Emergency Fund Alternative

Life throws curveballs. Medical emergencies, job losses, major car repairs – they all demand ready cash.

While financial experts recommend having 3-6 months of expenses in a dedicated emergency fund, the reality is many Americans don’t have that cushion. A HELOC can serve as a backup emergency fund.

The key advantages of this approach:

- No interest costs unless you actually use it

- Quick access to funds when truly needed

- Typically much lower interest rates than credit cards or personal loans

I’m not suggesting you skip building a proper emergency fund. But having a HELOC in place before an emergency happens gives you an additional safety net. Many homeowners sleep better knowing they have access to equity if disaster strikes.

Major Life Expenses

Sometimes life comes with big price tags attached.

A HELOC can help fund:

- Weddings (the average cost is now over $30,000)

- Adoption expenses (which can range from $20,000-$50,000)

- Fertility treatments not covered by insurance

- Care for aging parents

- Starting a small business

These meaningful life events often don’t have specific loan products designed for them. A HELOC’s flexibility makes it well-suited for these varied purposes.

For instance, if you’re planning a wedding, you might not know the exact final cost. With a HELOC, you can draw only what you need as expenses come up, potentially saving on interest compared to taking a personal loan for the maximum possible amount.

Investment Opportunities

This strategy isn’t for everyone, but some financially savvy homeowners use HELOCs to fund investments.

Common investment uses include:

- Down payments on rental properties

- Funding a business opportunity

- Investing in the stock market during significant downturns

The concept is simple but risky: borrow at a relatively low HELOC rate and invest for a higher return. The difference is your profit.

The dangers should be obvious. Investments can lose value, but your HELOC still requires repayment. This approach should only be considered by those with high risk tolerance, significant financial cushion, and thorough understanding of the investments involved.

Home Maintenance and Repairs

Your roof won’t last forever. Neither will your furnace, water heater, or windows.

Major home repairs are inevitable parts of homeownership, and they rarely come cheap:

- New roof: $8,000-$20,000

- Furnace replacement: $2,500-$6,000

- Foundation repairs: $2,000-$15,000

When these big expenses hit, a HELOC provides ready access to funds. Unlike personal loans, which might take days to process, a HELOC is already in place when you need it.

Smart homeowners sometimes establish a HELOC as part of their home maintenance strategy, knowing they can tap it quickly when the 20-year-old air conditioner finally gives up in the middle of July.

Medical Expenses

Even with health insurance, medical costs can be devastating. Deductibles, co-pays, and uncovered treatments add up fast.

A HELOC can provide funds for:

- High deductibles before insurance kicks in

- Procedures not covered by insurance (like many dental treatments)

- Medical travel costs

- Specialized treatments or second opinions

- Long-term care needs

When health issues arise, the last thing you need is financial stress compounding the situation. Having access to home equity can alleviate some of that pressure and let you focus on recovery.

Managing Variable Income

Self-employed? Freelancer? Commission-based sales? Your income probably has ups and downs.

A HELOC can help smooth out cash flow:

- Draw funds during slow months

- Repay during prosperous periods

- Maintain consistent household spending despite income fluctuations

This strategy requires discipline and clear boundaries. You’re essentially using your home equity as a buffer against income volatility, not as a way to artificially inflate your lifestyle during lean times.

Many small business owners use this approach to handle seasonal business cycles or unpredictable payment timelines from clients.

Vehicle Purchases

That car loan the dealership offered? It might not be your best financing option.

Using a HELOC to buy a car can offer advantages:

- Often lower interest rates than auto loans

- No need for vehicle-specific loan paperwork

- Flexibility to pay off quickly when funds become available

The downside is you’re securing a depreciating asset (the vehicle) with your home equity. But for homeowners with substantial equity and good financial habits, it can be a smart money-saving move.

This strategy works especially well for those planning to keep vehicles long-term, as the interest savings compound over many years.

Tax Planning Opportunities

In some cases, HELOC interest remains tax-deductible when used for home improvements that substantially add value to your property.

While the 2017 tax law changes limited HELOC interest deductibility, this potential tax benefit still exists for qualifying home improvements. Always consult a tax professional about your specific situation, as tax laws change and individual circumstances vary widely.

Examples of potentially qualifying improvements include:

- Major kitchen or bathroom remodels

- Room additions

- Foundation repairs

- New roof installation

- Energy-efficient upgrades

The potential tax savings make HELOCs even more attractive for serious home improvement projects.

Navigating Financial Transitions

Life transitions often come with financial challenges:

- Divorce settlements

- Relocation expenses

- Career changes

- Starting over after financial setbacks

A HELOC can provide transitional funding during these periods. The flexibility to draw exactly what you need, when you need it, makes it well-suited for situations where expenses might be unpredictable.

For instance, during a divorce, you might need funds for temporary housing, legal fees, or setting up a new household – all while your finances are in flux. A HELOC can provide that breathing room.

Disaster Recovery

Insurance doesn’t always cover everything when disaster strikes. Deductibles, coverage gaps, and delayed payments can leave you financially vulnerable after events like:

- Floods

- Fires

- Hurricanes

- Earthquakes

- Other natural disasters

A pre-established HELOC gives you immediate access to funds for repairs, temporary housing, or replacing essential items while insurance claims are processed.

After Hurricane Sandy, many homeowners relied on HELOCs to begin repairs quickly rather than waiting weeks or months for insurance settlements or government assistance.

Travel and Experience Funding

While financing vacations with debt isn’t generally recommended, there are situations where a HELOC might make sense for travel:

- Once-in-a-lifetime opportunities

- Family reunions or milestone celebrations

- Extended sabbaticals or gap years

- Educational travel experiences

The key is distinguishing between frivolous spending and meaningful experiences with lasting value. If you choose to use a HELOC for travel, having a concrete repayment plan before you depart is essential.

Some homeowners use this strategy for extended international experiences, knowing they’ll return to a higher income or with enhanced skills that increase their earning potential.

Strategic Remodeling Before Selling

Planning to sell your home in the next couple of years? A HELOC can fund strategic upgrades that maximize your selling price.

Real estate experts know that certain improvements deliver better returns than others. Using a HELOC to fund high-ROI projects can be a smart pre-selling strategy:

- Kitchen updates (potentially 75-100% ROI)

- Bathroom renovations (potentially 70-85% ROI)

- Exterior improvements for curb appeal

- Energy efficiency upgrades

- Necessary repairs flagged in pre-inspections

The goal is spending strategically on improvements that buyers value most, potentially recouping your investment plus additional profit when you sell.

Creating Accessible Living Spaces

As homeowners age or family needs change, homes often require modifications for accessibility:

- Wheelchair ramps

- Wider doorways

- First-floor master bedrooms

- Walk-in showers

- Stair lifts

These modifications can be expensive but necessary to remain in your home safely. A HELOC provides the flexibility to make these changes as needed, either all at once or in phases as requirements evolve.

For many families, these modifications are far less expensive than assisted living facilities or nursing homes, making them sound financial investments beyond the immediate quality-of-life improvements.

The Bottom Line on HELOC Uses

A HELOC is one of the most versatile financial tools available to homeowners. Its flexibility allows it to serve countless purposes throughout your homeownership journey.

The key to using a HELOC successfully is thoughtful planning:

- Borrow for purposes that maintain or increase value

- Have a clear repayment strategy

- Understand how the variable interest rate might affect your payments

- Remember you’re using your home as collateral

Used wisely, a HELOC can help you achieve goals, navigate challenges, and build wealth. But like any powerful tool, it requires respect and proper handling to avoid financial injury.

Your home is likely your largest asset. A HELOC lets you put that asset to work for you without selling it. That’s a powerful financial advantage – when used with care and forethought.

Connect with us

Get Expert Help with Your Home Equity Line of Credit

Need advice about a HELOC? Have questions about rates or qualification requirements? Our team is ready to help you navigate the sometimes confusing world of home equity borrowing.

Talk to a HELOC Specialist Today

Our financial experts eat, sleep, and breathe home equity products. They can explain the difference between fixed and variable rates in plain English, walk you through qualification requirements, and help you understand if a HELOC is even the right choice for your situation.

No pressure, no confusing jargon—just straight talk from people who know their stuff.

Schedule a Free Consultation

Why waste hours researching online when you can get personalized advice in minutes? Our consultations are:

- Completely free (seriously, no hidden fees)

- No-obligation (we won’t push you into anything)

- Available virtually or in-person

- Scheduled at your convenience

Visit a Branch Near You

Sometimes it’s just better to sit down face-to-face. Our branch locations have private meeting rooms where you can discuss your financial situation comfortably.

Not sure which branch is closest? Use our branch locator tool on our website to find the most convenient location for you.

Join Our Educational Webinars

Every month, we host free webinars covering different aspects of home equity borrowing. Topics include:

- Understanding HELOC vs. Home Equity Loans

- How to Get the Best HELOC Rates

- Smart Ways to Use Your Home Equity

- Avoiding Common HELOC Mistakes

Register on our website to save your spot. Can’t make it live? No problem—we’ll send you the recording.

Subscribe to Our Newsletter

Stay updated on HELOC rate trends, regulatory changes, and borrowing strategies by subscribing to our monthly newsletter. We promise not to flood your inbox—just one email per month with actually useful information.

You can customize your subscription to receive only the topics you’re interested in.

Follow Us on Social Media

Our social channels aren’t just promotional tools—they’re communities where homeowners share experiences and get quick answers to their questions.

Find us on:

We regularly post tips, answer questions, and share market updates that might affect your borrowing decisions.

Check Out Our Calculators and Tools

Before you reach out, you might want to play around with some of our free online tools:

- HELOC Payment Calculator

- Home Equity Estimator

- Debt Consolidation Calculator

- HELOC vs. Home Equity Loan Comparison Tool

These tools can give you a better idea of what questions to ask when you do connect with us.

Read Our Client Success Stories

Still not sure if we’re the right people to talk to? Check out stories from homeowners just like you who found the perfect home equity solution with our help.

We feature new stories each month, covering different situations and borrowing needs.

Request a Custom Rate Quote

Want to know what HELOC rate you might qualify for? Fill out our simple form for a personalized rate quote based on your home value, credit profile, and borrowing needs.

This isn’t a formal application—just a quick way to get ballpark figures without any impact on your credit score.